Home owners that owe more than their home’s are worth jumped from 23.1% in 2010 to 28.4% in 2011. This dramatic increase in homes that are “underwater” is further evidence that home prices have not yet hit ‘bottom’. There is still room for them to decrease. For those wanting to sell their home (or move) are in a bind because they simply can’t afford to pay the difference in their mortgage debt and what the house is worth.

Something further complicating the matter is new potential home buyers would rather rent than buy, couples are moving back in with parents, and a bad economy isn’t providing enough money to make a mortgage payment. New lending standards have also made buying a new home much more difficult (requiring as much as 20% down on the purchase of a new home).

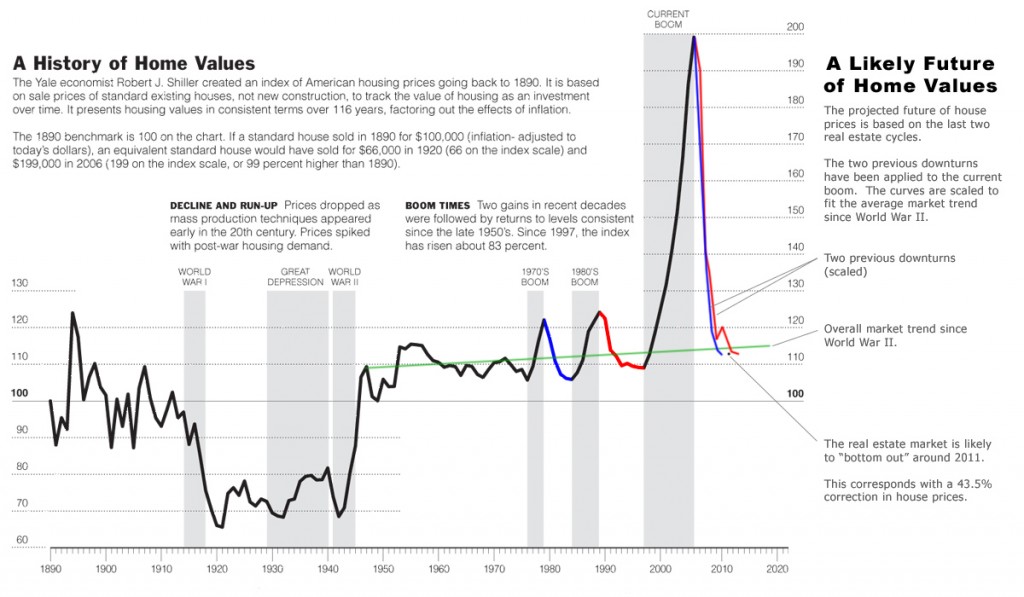

According to Robert Shiller of Yale, the housing market should ‘bottom out’ sometime this year (2011). With interest rates at a record low now would be a great time to buy, if you can afford it.