Compound Interest is one of the most important concepts in personal finance. By understanding the power of compound interest and how it works it will change your investing strategy, your mindset, and your goals. This concept is so powerful that Einstein is quoted as saying “The most powerful force in the universe is compound interest”.

The idea is simple. Compound interest is interest that becomes principle. When the earned interest becomes principle it starts earning interest on itself. To help illustrate, lets contrast Simple Interest with Compound Interest.

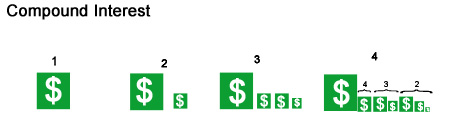

Key to Different Types of Interest

In the following example the icons that look like squares can earn interest. The squares are ‘money makers’. The hexagons can’t create money. They are paid out as interest.

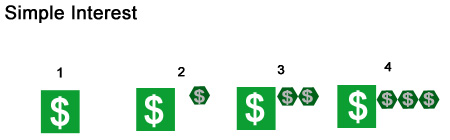

Simple interest keeps the earned interest and the principle separate. In other words, the interest never becomes principle. Simple Interest growth would look like this:

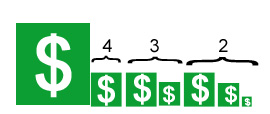

When Compound Interest grows it makes smaller pieces of principle which also earn interest. One of these new pieces of earned money changes from interest to principle when the account compounds. Investments can compound yearly, biannually, quarterly, monthly, and even sooner in some cases. The more something compounds the sooner you can make new money off earned interest.

The above illustration shows the interest making new amounts of interest from themselves. These new sums of principle will grow independently of the first sum of principle.

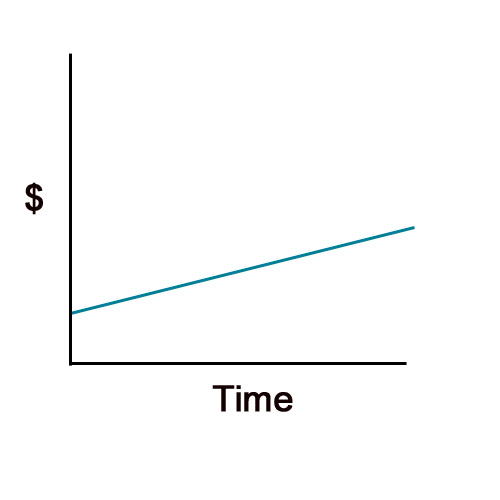

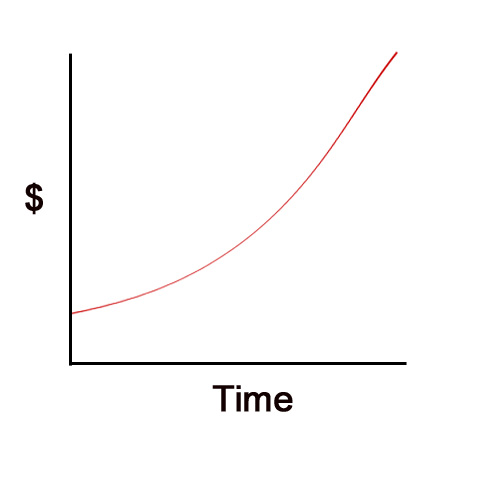

This graph shows the nature of compound interest. This is known as exponential growth. In order for you to see big results you need two ingredients: Time and Rate of Return.

What you need for Compound Interest to work well: Time and Growth Rate.

If you had 40 years to let your money grow you would be much better off than someone who only had 30, 20, or 10. Those last few years are critical to make the big returns. The sooner you pull your money out the sooner you stop all the compounding growth.

MoneyChimp Compound Interest Calculator

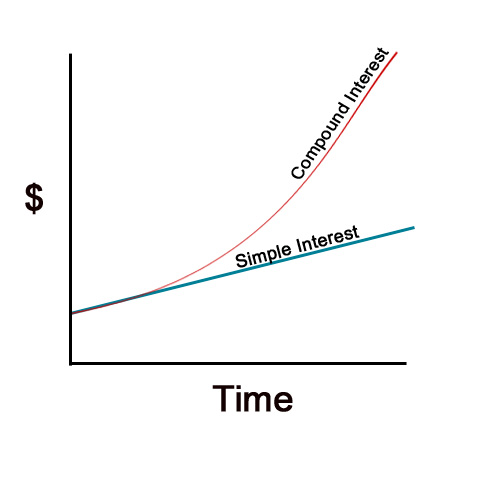

When you contrast simple growth with compound growth you can see the longterm difference between the two. Notice how similar the compound interest line and the simple interest line are in the beginning. The more time you give compound interest the more it will beat simple interest. The less time you give to compound interest the less it can perform.

Rule of 72

The rule of 72 helps you estimate how soon your money will double given a constant growth rate with compound interest. To use the rule of seventy-two take the growth rate and divide it into 72. The outcome will equal how many years it will take to double your money. This assumes a constant growth rate and that your investment is compounding.

72 / (growth rate) = Years to Double Investment

For example with a growth rate = 10%

72 / 10 = 7.2 Years

Answer: It will take 7.2 years to double your money with 10% return on your investment.

The rule of 72 isn’t an absolute but it will get you in the ball park. Another downside is that if your growth rate fluctuates too much the rule of 72 doesn’t work.

Summary

As you understand how compound interest works you can better plan your future. Compound interest is what makes retirement possible despite rising costs of living, inflation, and other costs. If you have any more to add please leave a comment.