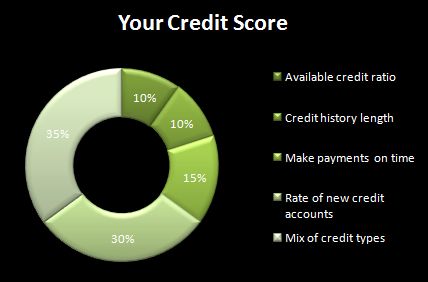

Understanding your credit score is divided into five areas. Each area helps lending instituions determine how risky you are. If you are a new creditor, with limited types of credit, and have made late payments, your credit score will be very low. On the other hand if you have a long history of payments with various types of credit your credit score will be very high.

The Five Areas in detail are:

What is your debt to available credit ratio? Simply put, are you maxed out. If you have a $1,000 credit card are you carrying a balance of $999 which goes past the limit occasionally? If you give yourself a zero here. Another part of this calculation is your debt to income ratio. If you make $35K a year and you have $20K in credit card and auto debt your ratio is not looking very good. Paying off your debt and living below your available debt will raise your credit score.

How long is your credit history? This is an important because it helps creditors discover your spending and debt habits. The longer you have handled debt responsibly the more credit they want to give you. When my brother was applying for a loan on his first house the loan agent told him to get a department store credit card. After he got a card and used it for a few months he was eligible for a mortgage. Kind of scary that a $100 in-store credit card could make it possible to buy a house but there it is.

Are you timely with your payments? Never be late on a single payment. In my experience if you are late by a day or two it doesn’t show up on your credit report. Besides having to pay a fee you won’t be in trouble there. If you are more than a month late you are getting a permanant mark on your credit report. While your score will rebound over time creditors will always be able to see your little boo boo.

How many credit cards are you applying for this month? If you are loading up on credit card accounts and buying new cars it will hurt your credit score. Every time you open a new line of credit your score takes a hit. If you open 2 or 3 cards within a month your sending the message that you’re crazy and intend to leave the country or something. Try to avoid this mistake before making a big purchase. It could cost you from buying your dream home.

How diverse are your lines of credit? If you have a number of different types of credit is shows that you’re mature with your accounts. If all you have is department store credit, and nothing else, it shows that you may not be capable of handling more credit. Try to apply for a signature loan instead of going to mom and dad for that small loan next time.